Wealth inequality tends to grow over time. Government must work to tax accumulated wealth to prevent the impoverishment of the majority. All private wealth above USD $1 million will be taxed at a rate of 10% annually.

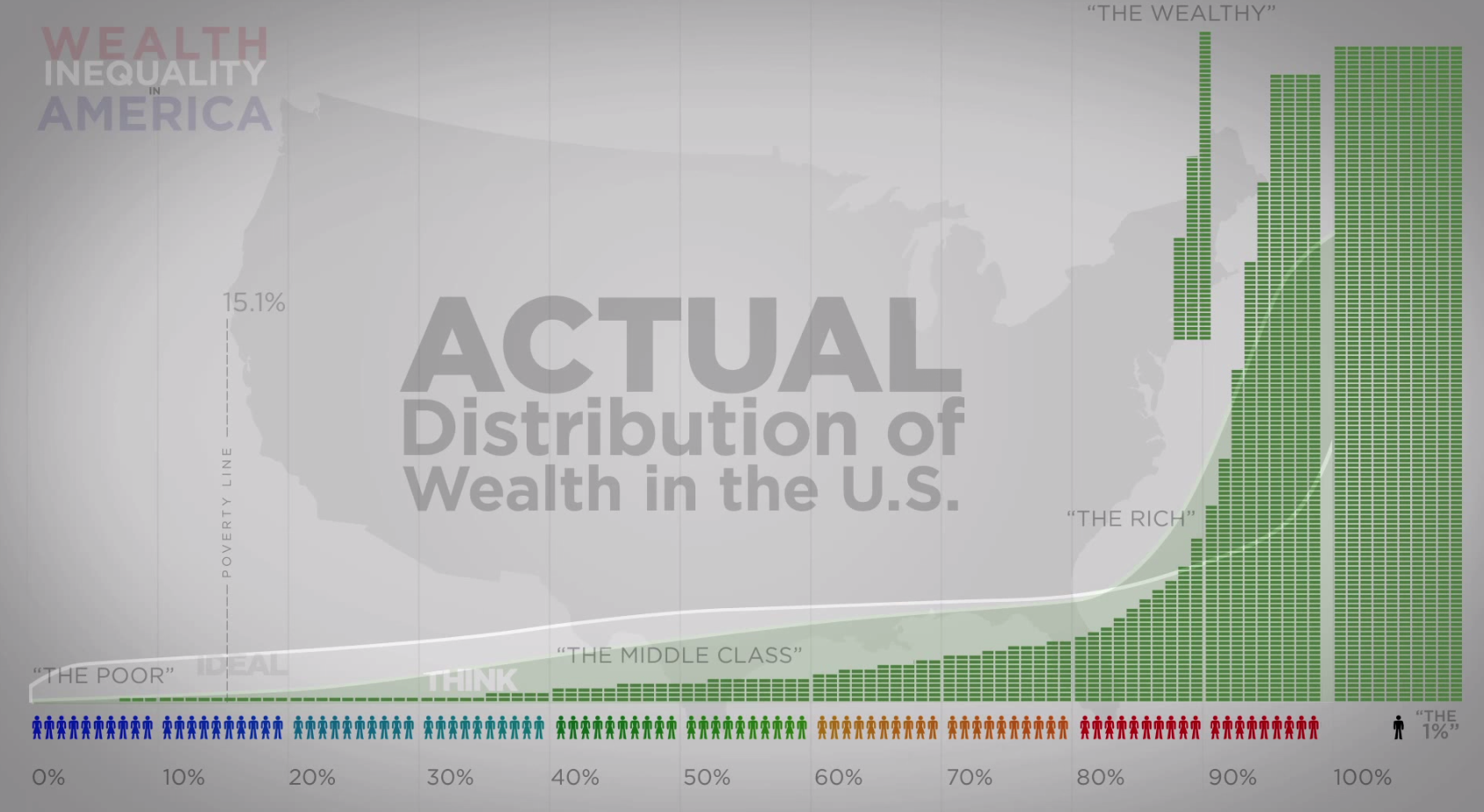

How extreme is wealth inequality? Take the case of the USA. The net wealth held by USA citizens and corporations has been calculated to be approximately $54 trillion. This is roughly three times the annual gross domestic project of the entire USA economy. Here is how this wealth is distributed:

No people can expect to achieve financial success or spiritual awakening if they are literally unable to survive. Universal, tax payer funded and high quality health care must be provided so that all people are able to worry less and enjoy better lives from birth to death. It is the duty of any government to provide this health care.

All people are endowed with physical, intellectual and spiritual faculties. All should be given an equal chance, through high quality, tax payer funded, education to develop all of those faculties to the extent they so desire. Financial or geographical limitations on the quality of education, from pre-kindergarden to secondary education must be eliminated.

No person or corporation will be allowed to reap profits from activities harmful to the environment. The cost of environmental destruction must be paid out of current profits and not passed to the society and future generations. Practices which cause increases in CO2 and other greenhouse gas emissions, practices which pollute ocean or fresh water, practices which poison the soil and make the environment harmful for living organisms must be made unprofitable.

No one should be forced to live in miserable circumstances because of their age or physical disability. Pension and disability benefits must be adequate for a life with dignity and must rise in line with the inflation of the cost of food, housing and other necessities.

An income tax reflects the contribution of the society to individual economic success. The tax must be simple, no exemptions, no deductions. It must be progressive to discourage inefficient allocation of capital. It must apply to all income regardless of the source.

The entire tax code for the USA can be reduced to this:

| income (USD) | tax rate | after tax income (top of bracket) |

|---|---|---|

| up to 50,000 | 10% | 45,000 |

| 50,001 to 100,000 | 15% | 87,500 |

| 100,001 to 150,000 | 20% | 127,500 |

| 150,001 to 200,000 | 25% | 177,500 |

| 200,001 to 250,000 | 30% | 215,000 |

| 250,001 to 300,000 | 35% | 250,000 |

| 300,001 to 350,000 | 40% | 295,000 |

| 350,001 to 400,000 | 45% | 312,500 |

| 450,001 to 500,000 | 50% | 390,000 |

| 500,001 to 1,000,000 | 60% | 540,000 |

| above 1,000,000 | 70% | (e.g. 2,000,000) 840,000 |

All people beginning from working age will receive a social dividend, or minimum monthly income, which represents a share of the overall wealth of the society (which includes such things as natural resources, return on public investments such as research and development, etc.) This income is not means tested, there are no restrictions on its use and it is the only income not subject to income tax.

For the USA, this amount should be USD $1,000/month and replace all manner of state (e.g. Alaska annual oil dividend) dividends and historical welfare system payments. This would cost about USD $3 trillion annually, or roughly 20% of annual GDP.

Democracy, one adult person, one vote is necessary but not sufficient for a free and just society. A policy to increase citizen participation as much as possible (using direct democracy) must be implemented. Further all elections should be tax payer funded, and equal access to media and public forums must be provided to all parties who demonstrate 1% or more public support (by membership or by polling over 1% in nationwide elections.) Proportional representation must be the norm rather than winner take all elections.

The promotion of peaceful relations between all peoples must be a central policy objective. The gradual reduction and eventual elimination of all forms of military equipment and of military bases, facilities, forces (overt, clandestine or advisory) in foreign territories is essential to securing a peaceful and prosperous world for all.